In today’s fast-paced business world, you must keep your enterprise agile and secure. Implementing continuous audit frameworks ensures that your internal processes stay efficient and transparent. You can identify weak spots early and take corrective action. These frameworks, grounded in real-time monitoring, help you spot discrepancies quickly. As a growing enterprise, adopting these practices improves decision-making and enhances trust among stakeholders. Consider the experience of a CPA in Bowie County, Texas, who integrated continuous audits into their practice. This decision led to improved financial accuracy and client confidence. By taking similar steps, you can ensure your organization remains competitive and compliant. These audits are not just beneficial—they are necessary. Your enterprise’s growth depends on streamlined operations and consistent evaluations. Continuous auditing helps you meet these goals. Stay ahead and maintain a clear financial picture. With this approach, you build a reliable foundation for your enterprise’s future success.

What is Continuous Auditing?

Continuous auditing involves the frequent and automated examination of financial transactions. Unlike traditional audits, which occur periodically, continuous audits provide ongoing insights. This method allows you to detect issues promptly rather than waiting for the end of a financial period. Implementing this approach means you can respond to potential problems swiftly.

By automating data analysis and applying consistent audit procedures, continuous audits reduce manual error and increase accuracy. This process enhances the reliability of financial reports, ensuring they reflect the true state of your enterprise at any given moment.

Benefits of Continuous Audit Frameworks

- Improved Accuracy: Automated systems minimize human errors, providing more reliable data.

- Timely Detection: Real-time monitoring allows you to identify and address issues before they escalate.

- Cost Savings: Early detection and resolution of issues can reduce the cost associated with significant financial discrepancies.

- Increased Trust: Stakeholders gain confidence in the transparency and reliability of your financial reporting.

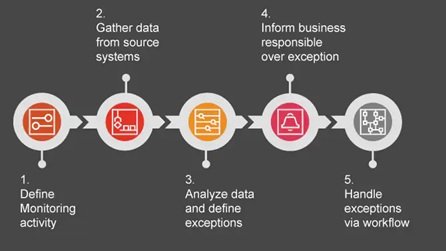

Steps to Implement Continuous Auditing

To successfully integrate continuous auditing, follow these steps:

- Assess Your Needs: Determine the specific areas where continuous auditing will be most beneficial. Identify the processes that will gain the most from real-time oversight.

- Select the Right Tools: Choose auditing tools that align with your enterprise’s goals. Look for software that offers automation, data analytics, and integration capabilities.

- Train Your Team: Ensure your team understands how to operate the chosen tools correctly. Provide training to ensure smooth implementation and operation.

- Integrate with Existing Systems: Continuous audits should work seamlessly with your current systems. Ensure compatibility to maximize efficiency and data flow.

- Monitor and Adjust: Regularly review the effectiveness of your audit processes. Make adjustments as needed to address new challenges or business changes.

Comparison of Traditional vs. Continuous Auditing

| Aspect | Traditional Auditing | Continuous Auditing |

|---|---|---|

| Frequency | Periodic | Ongoing |

| Response Time | Delayed | Immediate |

| Cost | Varies | Potentially Lower |

| Data Accuracy | Moderate | High |

Overcoming Challenges

Transitioning to continuous auditing does present challenges. Resistance to change is common. Address concerns by demonstrating the benefits and involving your team in the process. Limited resources may also hinder implementation. Start small and expand as you see positive results. Security concerns about data handling are valid. Choose software with strong security measures and ensure compliance with relevant regulations to protect sensitive information.

Conclusion

Continuous auditing is not just a trend. It’s a strategic decision for enterprises wanting to thrive. By implementing these frameworks, you ensure greater accuracy, responsiveness, and trust. The experience of adopting continuous audits, as seen with the CPA in Bowie County, Texas, highlights the tangible benefits. By carefully planning and embracing the change, your enterprise will be well-equipped to face future challenges with confidence and clarity. Take the steps today to implement continuous auditing in your organization, ensuring a robust and transparent financial future.