Table of Contents

- Understanding Payroll and HR Platforms for Small Businesses

- Standard Pricing Models for Payroll and HR Services

- Typical Costs and Fees Small Businesses Might Encounter

- Factors That Influence Payroll and HR Platform Pricing

- Hidden Costs and How to Avoid Them

- Comparing Providers: What Matters Most Besides Price

- Industry Trends Shaping Payroll and HR Pricing

- Steps to Choose the Right Payroll and HR Platform

- Conclusion

Understanding Payroll and HR Platforms for Small Businesses

Payroll and HR platforms have become essential tools for small businesses seeking to streamline back-office operations, enhance accuracy, and focus on growth. These platforms simplify complex tasks such as salary calculations, tax compliance, employee benefits administration, onboarding, and more. With time-consuming paperwork and ever-changing legal requirements, small business owners increasingly rely on technology to handle payroll and HR functions efficiently.

The right platform offers much more than just paycheck processing—it boosts compliance, tracks time off, integrates with accounting software, and supports rapid growth by scaling with business needs. Transparency in pricing is crucial for making informed choices. For a robust understanding of payroll pricing transparency, reviewing how fees are structured and disclosed gives owners the clarity needed to compare vendors confidently.

A strong payroll and HR system does more than keep the lights on. It ensures legal compliance, fosters employee trust through reliable payment and benefits delivery, and liberates business owners from repetitive administrative burdens. These platforms can be the difference between a reactive, error-prone process and a proactive, smoothly running business infrastructure.

As your company grows, so do the complexities of labor laws and compliance. Investing in a scalable payroll and HR solution ensures that you remain agile, regardless of how regulations change or your team grows.

Standard Pricing Models for Payroll and HR Services

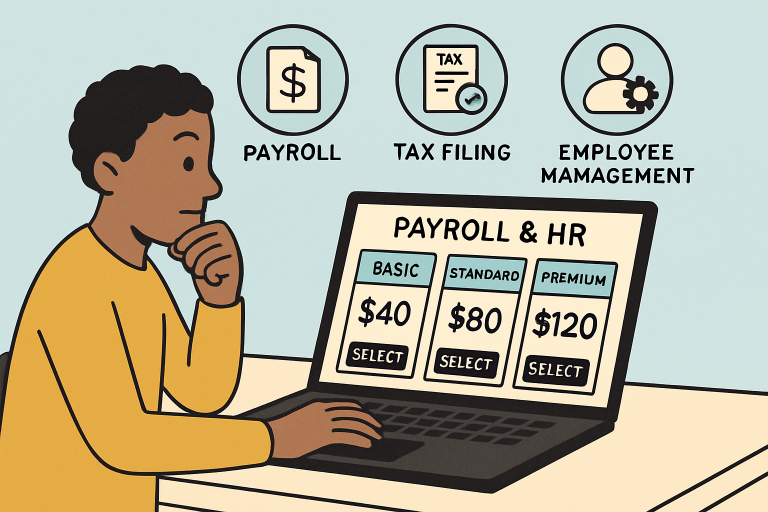

Pricing for payroll and HR services varies, with most providers offering subscription models, pay-per-use options, or charges based on the number of employees. Subscription plans typically involve a fixed monthly fee, plus per-employee charges, covering core features such as payroll processing, standard reports, and limited support. Pay-per-use options may be suitable for businesses with occasional payroll needs, while per-employee costs increase as your team grows. To explore detailed pricing structures for SMB HR software—ranging from basic plans at just $2 per user per month to full packages with recruiting, payroll, benefits, and personalized support—see the HR Software Pricing Guide by Forbes Advisor.

Carefully reviewing these options allows business owners to match costs with the exact level of service they need. Taking the time to compare plans can ultimately save money while ensuring the right support for long-term growth.

Commonly, the base price covers payroll processing, direct deposits, tax calculations, and basic reporting. However, essential services—such as tax filings, year-end forms, or special reporting—may incur additional fees. Understanding these distinctions allows owners to budget more accurately and avoid unexpected expenses.

It’s essential to scrutinize not just price tags, but also what’s included. Will you need add-ons for time tracking, benefits administration, or integrated HR tools? Knowing what’s standard vs. extra is vital for cost forecasting and selecting the right fit.

Typical Costs and Fees Small Businesses Might Encounter

While seeking a payroll or HR platform, small businesses should be prepared for several distinct costs:

- Setup and Implementation Fees: One-time charges for onboarding your business to the new system, migrating data, and initial configuration. These range from nominal fees to several hundred dollars, depending on complexity and provider.

- Monthly Service Fees: Core charges that cover platform access, often combined with per-employee or per-payroll costs.

- Additional Costs: These may include quarterly and annual tax filings, W-2/1099 preparation, off-cycle payroll runs, garnishment processing, or premium customer support. Some platforms offer these à la carte, while others bundle them into higher-tier plans.

Budgeting for the “whole picture” prevents surprises at year-end and ensures your HR and payroll solution delivers reliable value.

Factors That Influence Payroll and HR Platform Pricing

Several critical factors determine what you’ll pay for a payroll and HR platform:

- Number of Employees and Payroll Frequency: More staff or frequent paychecks typically result in higher fees, especially if services are billed per employee or per run.

- Industry-Specific Regulations: Businesses in highly regulated industries often require customized compliance solutions, which can impact overall costs.

- Level of Customization and Integration: Integrating with existing accounting or HR systems, or requiring tailored workflows, often incurs additional expense.

- Additional Features: HR compliance tools, onboarding modules, advanced analytics, and dedicated support can raise the price, but also add significant value and protection.

Hidden Costs and How to Avoid Them

Owners often face hidden fees that can erode budget and trust. Examples include charges for historical payroll data migration, mandatory year-end form processing, or higher-than-anticipated costs for multi-state tax filing. To avoid such surprises:

- Carefully review contracts and service agreements. Look for sections labeled ‘additional services,’ ‘premium features,’ or ‘termination clauses.’

- Ask direct questions about all possible extra charges, including customer support tiers, software upgrades, and compliance changes.

- Read reviews or seek references from similar businesses to assess the honesty and transparency of their billing practices.

Comparing Providers: What Matters Most Besides Price

Although cost is important, it shouldn’t be the only consideration. User experience—how easy, quick, and dependable the software feels—impacts productivity and helps prevent errors. Exceptional customer support can address problems promptly, avoiding payroll delays or damaging employee trust. Additionally, data security and compliance are crucial, particularly when handling sensitive employee data and adhering to labor regulations.

Industry Trends Shaping Payroll and HR Pricing

Small business payroll and HR services are evolving rapidly. The rise of integrated HR platforms—covering payroll, benefits, compliance, and employee engagement—provides greater convenience and competitive pricing. These innovations enable small businesses to access advanced features affordably, allowing owners to focus less on administrative tasks and more on strategic planning and growth. Be on the lookout for platforms offering modular pricing, AI-driven compliance tracking, and flexible integrations.

Steps to Choose the Right Payroll and HR Platform

Selecting the right solution doesn’t just depend on headline prices. Use this checklist to evaluate your options:

- Define your essential requirements (payroll, benefits, onboarding, compliance, integrations).

- Request complete cost breakdowns, including extra services and future scale.

- Assess software usability and demo platforms if possible.

- Compare customer support policies and response times.

- Review security certifications and compliance guarantees.

- Consult with a payroll expert or business advisor for tailored guidance.

A platform that fits your budget, streamlines operations, protects your data, and grows with your company is the best investment you can make.

Conclusion

Payroll and HR platforms have become indispensable tools for small businesses, offering far more than simple paycheck processing. They streamline compliance, reduce administrative burdens, and enhance employee trust while supporting scalability as a business grows. While cost remains a central factor, it is equally important to weigh transparency, features, user experience, and customer support. Understanding standard pricing models, common fees, and potential hidden costs ensures owners can make informed and confident decisions. By carefully evaluating needs, comparing providers, and considering both immediate and long-term value, small businesses can select a platform that not only fits their budget but also empowers them to focus on sustainable growth and strategic priorities.